With India’s travel sector projected to become the fifth-largest outbound travel market by 2027, the growth of Indian railways is imminent.

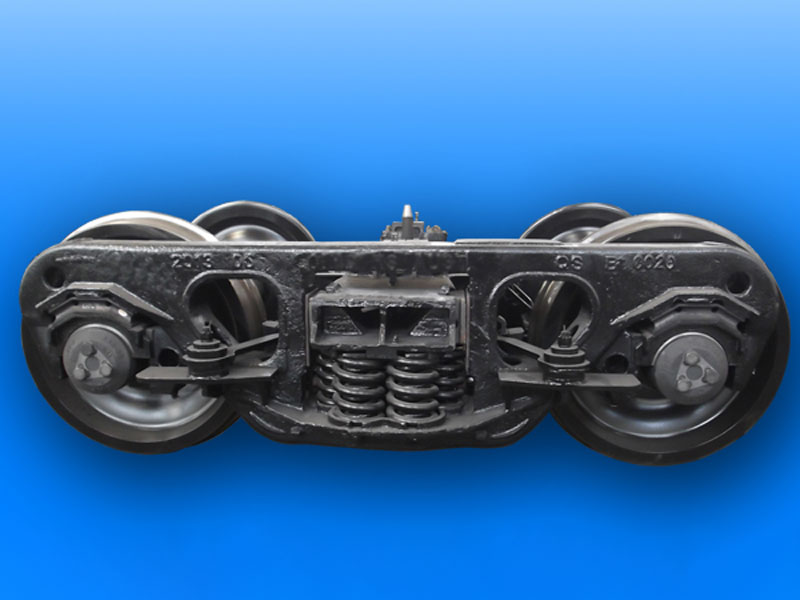

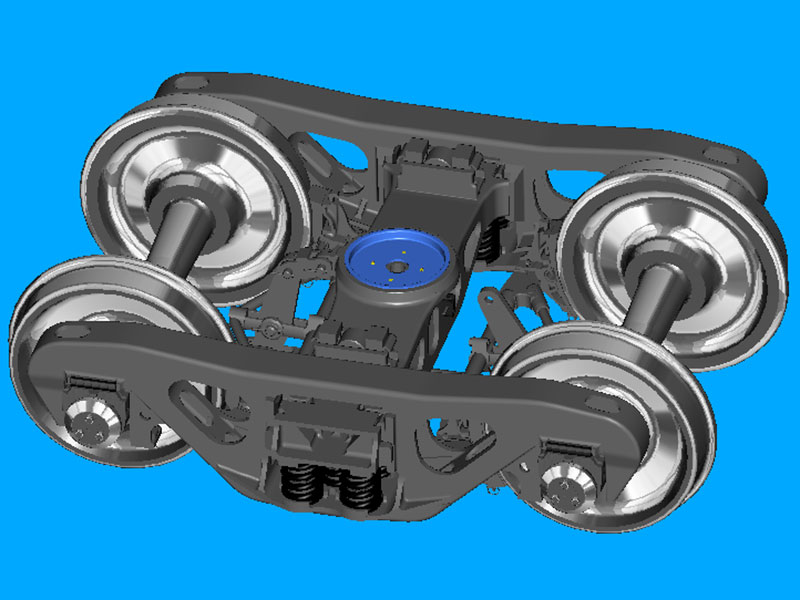

India needs to up its game and increase the daily train numbers substantially to meet the surging demand in the travel sector. Rolling Stock Bogie Parts

The Indian Railways is gearing up for a massive investment of ₹ 1 trillion (tn) in acquiring new trains in response to this rise in demand.

Besides the top railway stocks in India such as RVNL, Ircon International, Rites, IRCTC, there’s a separate category of stocks in this industry– the railway ancillary sector.

Locomotives and wagons apart, think about signalling systems, freight logistics, construction firms, and even technology providers.

Railway ancillary companies are the unsung heroes of the railway world, driving modernization and efficiency. Like auto and auto ancillary stocks, the performance of railway and railway ancillary stocks goes hand in hand.

In this article, we’ll look at all the listed railway ancillary stocks in India.

#1 K&R Rail Engineering

First on this list is K&R Rail Engineering.

The company is engaged in carrying on the business of laying private railway sidings on a turnkey basis.

This also includes independent techno-economic and engineering surveys, planning, and project management for private railway players.

Supported by healthy execution of its order book, the company has seen a sharp spike in its revenue for FY23.

The company has usually finished most of its projects before or on time for which it has also been rewarded with a bonus.

Over the years, it has built a strong list of clients which includes Ramco Cements, ACC, Kakinada Seaports, Paradip Port Trust, AP State Ware Housing Corporation, Essar Constructions, JSW Cement, Tata Projects, among others.

The healthy execution has resulted in its client giving repeat orders to K&R Rail.

But one should be mindful of the fact that majority of its orders come from the top 5 clients, so any repeat order cancellation from them is a big threat that it faces.

In late November 2023, the company signed a memorandum of understanding (MoU) for execution of the world’s longest cable car project in Nepal. The cost for this project is estimated at half a billion US dollars.

So far in the first and second quarters of FY24, K&R Rail has posted growing profits while operating margins have also improved.

With more orders coming in and execution in full speed, the company is expected to post better earnings going forward.

While it has maintained a debt-free status, promoters of the company have reduced their stake for the past two quarters. Still, the promoter holding stands above 50%.

In the past one year, shares of the company have rallied over 800%!

K&R Rail Share Price – 1 Year Performance

Next on this list we have Kernex Microsystems.

It manufactures, installs, and maintains anti-collision devices, and conceptualises, designs, and develops railway safety and signal systems.

The railway Kavach system that every train needs, is one of the systems developed by Kernex.

It helps in cases of human error when a locomotive pilot ignores or jumps a signal or over-speeds. The system can assist train operations even during bad weather conditions.

Despite the company being one of the few niche firms involved in this space, it has failed to capitalize on growth with sales showing a degrowth over the years while it also posted a loss for FY22 and FY23.

To put things into context, it has posted a loss for 10 consecutive quarters now.

However, the way it has been getting orders for the past couple of months owing to the increased demand, a turnaround seems very near for Kernex.

Recently, the company’s JV firm received an order worth ₹ 1.1 bn. This contract for comprehensive signalling and telecommunication works for provision of automatic block signalling system should be executed in the next two years.

Going forward, the company aims to enhance railway operations, increase efficiency, and ensure passenger safety through their innovative technological solutions.

In the past 1 year, shares of the company have rallied over 100%.

Third on this list is Oriental Rail Infrastructure.

The company is engaged in the manufacturing, buying, and selling of all types of recron, seat & berth, and compreg boards.

It has a track record of almost about three decades in supplying various products to Indian railways.

It enjoys over 50% market share in the seats & berths segment.

In FY23, the company saw a steep spike in its revenue, but it failed to capitalize on the profitability after posting a loss in the last quarter of the year.

However, it’s all set to post better earnings this year as the performance of first two quarters was more than satisfactory and much higher compared to the previous year’s quarters.

Financial Snapshot

Over the years, Oriental Rail has expanded its product offerings including coupler body and bogies while it also forayed into manufacturing of railway wagons in FY19.

It currently has an order book of around ₹ 14 bn, with majority of orders coming from various subsidiaries of Indian Railway.

Every order win is rewarded with an upper circuit or rating expansion, without enough stress on the company's ability to execute, to earn decent margins and returns, and on its ability to manage finances and cash flows.

This has been the case for Oriental Rail as its share price has spiked over 250% in the past one year.

It recently signed an agreement with a Russian company - United Waggon - to provide full design, technical details, and support for modern wagons and bogies for Indian Railways.

Going forward, a healthy order book and the commencement of its enhanced bogie and wagons manufacturing capacity is expected to drive growth.

Next on this list is Ramkrishna Forgings.

Not totally a railway play, the company caters to several industries including earth moving and mining, general engineering, oil exploration, and most importantly the railways.

It manufactures and sells forged components of automobiles, railway wagons & coaches and engineering parts, and claims the status as the 2nd largest forging player in India.

The company was recently in news for its ₹ 10 bn fundraising plan via a qualified institutional placement (QIP) for deleveraging and part-funding its growth plans.

Last year, along with Titagarh Wagons, Ramkrishna Forgings received an LOA for manufacturing and supplying of forged wheels for the Indian Railways.

The company will establish a manufacturing plant in India for production of 200,000 forged wheels per annum which is expected to start operations by end of FY26.

Ramkrishna has undertaken a massive capex plan where a total capacity of 25,000T will be added for which it’s spending over a billion rupees.

This cold forging press line is expected to be commissioned by the first quarter of FY25 and the entire 100% capacity has been booked by an OEM, valid for 7 years.

It should not come as a surprise that this company which has charted a growth trajectory in recent months, saw massive improvement in its financials.

Healthy execution has resulted in repeat orders from the same clients and having presence in the industry for almost 4 decades always helps.

Shares of the company are currently trading near all-time high levels with most of the gains coming in the past nine months.

Ramkrishna Forgings Share Price – 1 Year Performance

Going forward, Ramkrishna Forgings is all set to become net debt free.

It recently acquired ACIL, which is engaged in the manufacturing of high precision engineering automotive components.

Next on this list is Siemens.

Siemens is a pioneer in infrastructure facilities, digitalisation, and electrification in India. It is one of the world's largest producers of energy-efficient resource-saving technologies.

It was the budget 2023 announcements that got the ball rolling for Siemens. The order book of Siemens has been growing because of the shift in government focus.

In January 2023, the company won the biggest-ever railway order. It won an order of around ₹ 260 bn. It includes an order of 1,200 locomotives from the Indian railways.

These 1,200 locomotives will be delivered over the period of 11 years followed by a maintenance period of 35 years.

The recent earnings report of Siemens suggests that it’s all set for another year of bumper earnings as private capex turns around the laggard cycle.

The company’s order book and earnings growth anticipated over the next two years suggests that the best is yet to come for Siemens.

As far as recent developments go, Siemens shares have been rising with momentum after initiating the demerger of its energy business.

The railways sector is witnessing big changes as the government became more transparent and driven toward modernisation and electrification of railways.

The management of Siemens intends to be a part of this process of developing an efficient railway sector and in return gain big orders.

And that’s how Siemens is all set to play theupcoming railway capex theme.

Apart from that, the focus of the government with the PLI scheme is on semiconductors, batteries, etc, and these are areas where Siemens is present, both in its technologies as well as in the software offerings.

Next on this list is BHEL.

The company is a leading integrated power plant equipment manufacturer in India.

It performs design, engineering, manufacturing, erection, testing, commissioning, and servicing of a wide range of products across various sectors, including power, transmission, transportation, renewable energy, oil and gas, anddefence sectors.

In the past one year, it has bagged a slew of orders from Indian railways as it starts modernising the network with Vande Bharat trains, tech changes, among other things.

The significant Vande Bharat order was won by a consortium led by Titagarh Rail Systems and BHEL back in June 2023.

It signed for manufacturing 80 fully assembled Vande Bharat sleeper train sets by 2029 and maintaining them for a period of 35 years.

This marked the first ever mega order by Indian Railways which was entrusted by an Indian consortium. The estimated value of this contract is ₹ 240 bn.

Coming to its financials, the company’s revenue has grown at a compound annual growth rate (CAGR) of 9.2%, driven by a healthy order book in the last three years.

It reported a net profit of ₹ 4.7 bn in financial year 2023, as against a net loss of ₹ 26 bn three years ago.

As far as stock performance is concerned, BHEL shares have risen 145% in the past one year.

BHEL Share Price – 1 Year Performance

Recently, Rail Infrastructure Development Company of Karnataka invited bids to procure 306 air-conditioned, metro-like coaches for the Bengaluru Suburban Railway Project and BHEL was among the qualifying companies.

As of December 2023, its orderbook has surpassed the ₹ 1 trillion mark.

Last on this list is Texmaco Rail & Engineering.

Part of the Adventz Group, Texmaco is involved in manufacturing freight cars, auto car wagons, loco bogies, coach bogies, hydro-mechanical equipment, and steel casting.

It is also involved in designing, supplying, installing, and commissioning mainline railway and metro tracks.

The company has five manufacturing facilities in West Bengal and Chhattisgarh and is one of the largest suppliers of freight cars in India.

It supplies its products to several companies, including Indian Railways, Grasim, Vedanta, ACC Cement, Adani Ports, and SAIL.

The company’s profit has seen steady ups and down over the years.

This is because an increase in the prices of important raw materials such as steel and other commodities have affected the margins at regular intervals.

Texmaco Rail has started taking measures to improve its operations and reduce costs. The same can be seen in the rising profit margins in the last three years.

It is currently manufacturing 500 wagons a month and is aiming to hit 1,000 in the next few years.

The company is also looking for export opportunities in African and European countries to improve its export revenue.

It is also working on backward integration to reduce costs and improve margins.

Texmaco also recently received an equity infusion through preferential allotment and through a QIP issue of ₹ 7.5 bn.

In the past one year, shares of the company have surged over 220%.

Apart from the above seven, there are some more companies like Apar Industries, Elgi Equipment, HBL Power, and TD Power that are doing something on the railway side.

You should also keep these stocks on your watchlist as the country focuses on upgrading its railway infrastructure to achieve higher efficiency and reliability.

As can be seen from the share price performance of all the top railway ancillary stocks, we can observe that they’ve seen a massive spike in their stock prices as they got orders on top of orders.

For now, this has given a big boost to their future earnings visibility.

A good way to analyse whether the company's growth prospects look stronger than ever is to compare its order book with the current marketcap.

A large order book relative to a smaller marketcap may indicate undervaluation and strong future earnings, while the opposite scenario could signal overvaluation or operational inefficiencies.

In conclusion, 2024 could be a year where investors could either face disappointments if earnings growth of these companies does not keep up with expectations.

Or it could be a surprise year where these stocks continue their good run… no one knows really.

One thing is sure, it would not be wise to expect similar returns from them in 2024 compared to anexcellent year like 2023.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com

Download the Mint app and read premium stories

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

Wheel For Railway Wagon This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp